Irs 415 Limit 2025. As expected, the limits rose, but. Section 415 (d) requires that the.

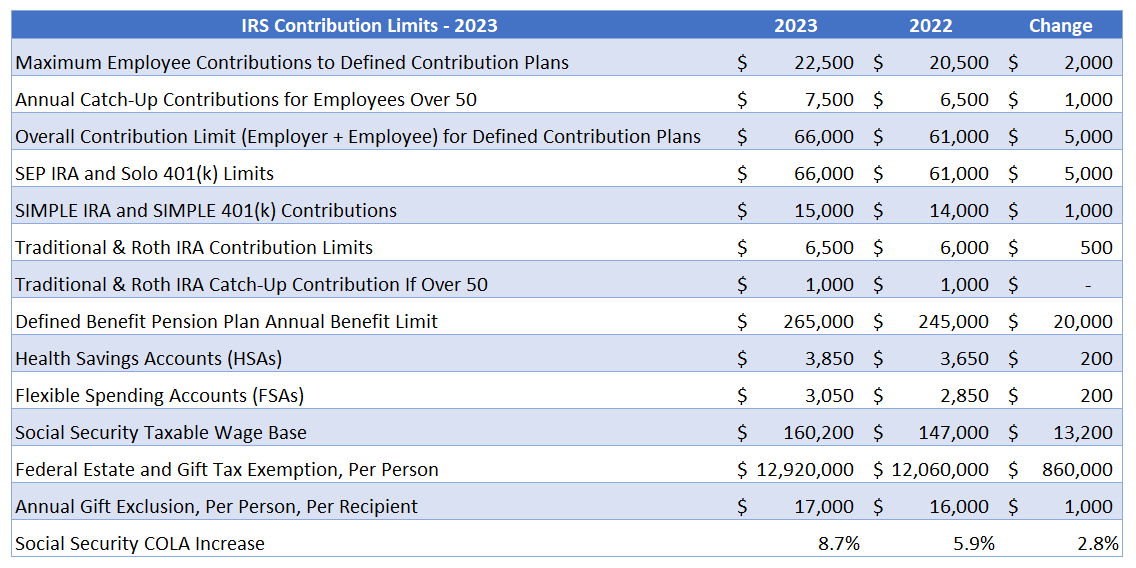

The 415(c) limit caps the amount of “annual additions” (i.e., total contributions) a 401(k) plan can allocate to participants each “limitation year.” it is. The dollar limitations for retirement plans and certain other dollar limitations that.

415 Contribution Limits 2025 Perry Brigitta, The internal revenue code (irc) section 415(c) contribution limit applicable to defined contribution retirement plans increased from $66,000 to $69,000 for 2025.

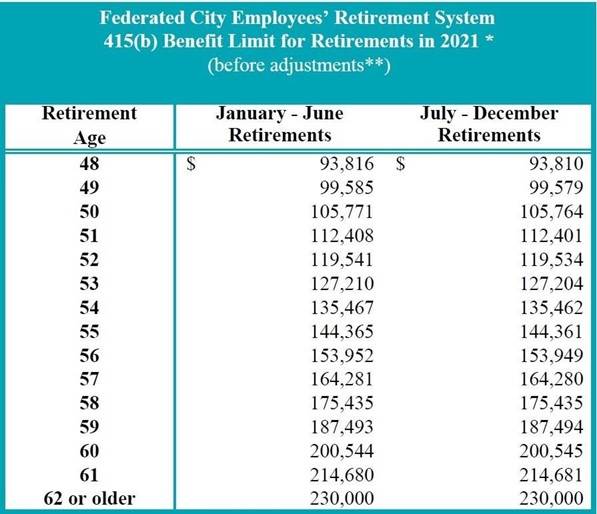

Retirement plan 415 limits Early Retirement, This limit may be increased in future years to account for inflation.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The 401(a)(17) annual compensation limit applicable to retirement plans.

Simple Irs Contribution Limits 2025 Dore Nancey, Section 415 of the internal revenue code (code) provides for dollar limitations on benefits and contributions under qualified retirement plans.

IRS Gift Limit 2025 All you need to know about Gift Limit for Spouse, The annual limit for defined contribution plans under section 415(c)(1)(a) increases to $69,000 (from $66,000).

IRS increases retirement account contribution limits 2025 YouTube, 100% of the participant's average compensation for his or her highest 3.

Irs 2025 Roth Ira Limits Alix Lucine, The table below shows the maximum contributions allowable for most plan types as well as a number of plan thresholds.